The Risk of Foreign Currency Indexed Loans

Not only does it pose a risk for those who incur in debt and the creditor banks particularly, but for the Venezuelan banking system, overall

The recent authorization given to Venezuelan banks to issue loans indexed in foreign currency deepens the de facto dollarization the Venezuelan economy has been experiencing since 2019. With this measure, the government isn’t only allowing commercial and transactional dollarization, but it’s opening the doors to financial dollarization, albeit in a limited way.

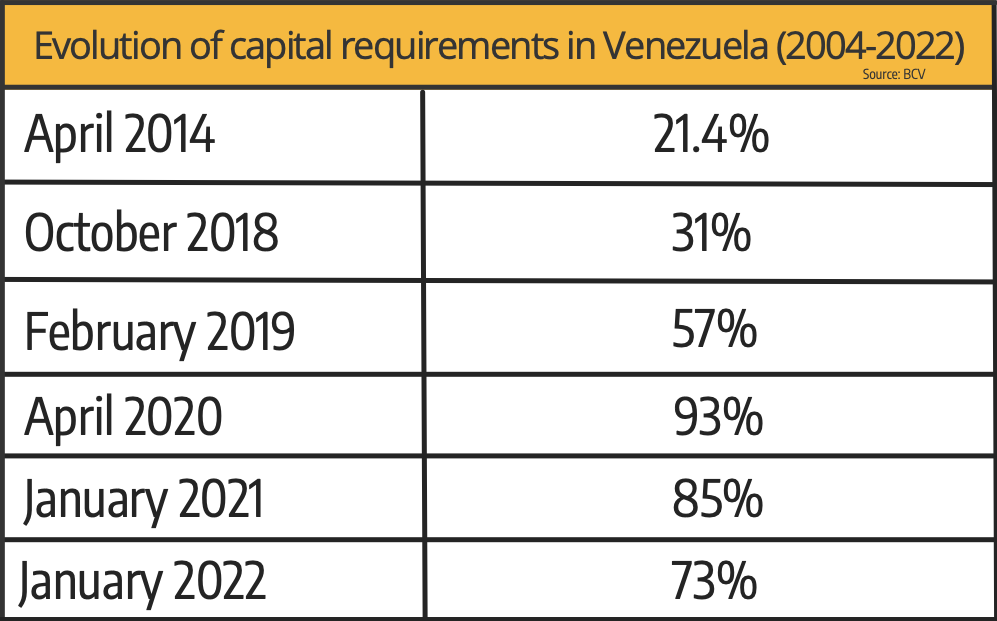

The government lowered the capital requirements from 85% to 73% and allowed issuing loans with 10% of dollars and other foreign currencies already deposited in the national banking system.

This move could put in circulation between 75 and 150 million dollars extra in the economy in the short term, financing for all sorts of corporate projects, among them new startups and commercial and industrial projects.

Although the amount is marginal, it meant great news for many because if there’s anything that can help boost a country’s economic growth and unleash an expansive multiplying effect, it’s precisely bank credits, a determining factor for wealth and job opportunities.

In Venezuela, bank credits all but disappeared. With hyperinflation (2017-2021), extreme devaluation of the bolivar, eight years of economic recession (2014-2021) and so many failed economic, financial, and monetary policies executed, loans pretty much disappeared in the past few years.

Mortgages no longer existed, as well as credit cards, loans to buy vehicles or appliances, and loans to finance large construction projects or major corporate initiatives.

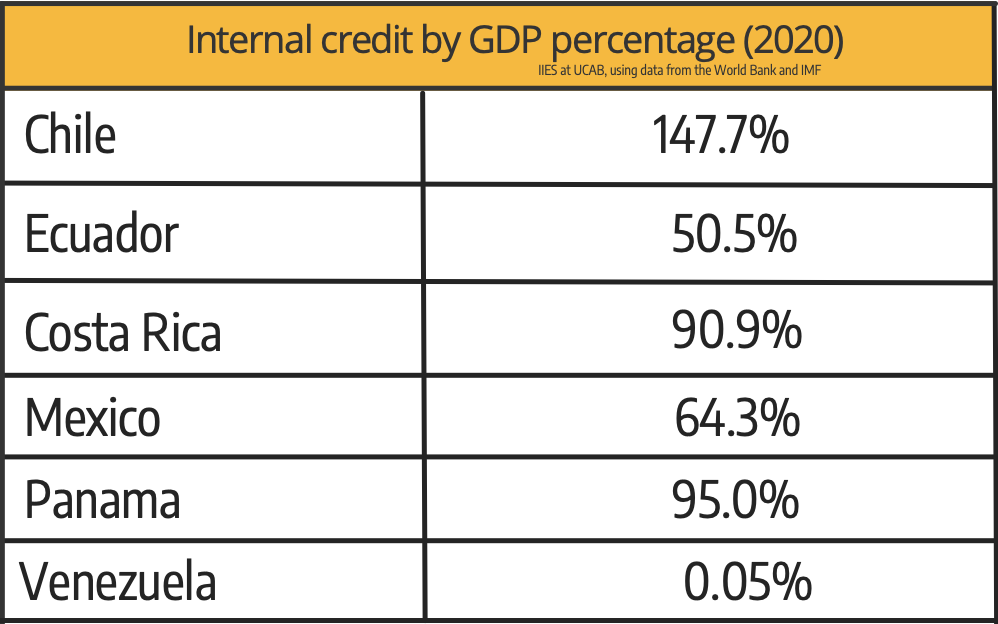

According to the most recent data released by the BCV (Banco Central de Venezuela), the private sector’s credit portfolio in Venezuela in late November 2021, was the equivalent of 364 million dollars, which represents less than 1% of the GDP. If we add the 150 million given by indexed loans authorized for 2022, we’re talking about just over 500 million dollars, 1.15% of the GDP.

In any case, it’s still a meager amount when compared to other Latin American countries, such as Chile (147.7%), Panama (95%) or Mexico (84.3%), but it represents a huge growth compared to what was registered in 2020 (0.05%).

“Restrictions of liquidity generated by disproportionate reserve requirements, the low credit demand brought by the contraction in the internal activity levels, and the high cost of credit caused by indexing the loan values to the varying currency exchange, have resulted in banks changing their roles: from being financial middlemen to institutions whose main function is transactional,” the Instituto de Investigaciones Económicas y Sociales (IIES) at Universidad Católica Andrés Bello (UCAB) points out in their latest Informe de Coyuntura Económica.

Fedecámaras, one of Venezuela’s main business chambers, has acknowledged that reactivating bank loans in Venezuela is good news for the private sector, as a potential driver for the economy, but prestigious economists from the IIES-UCAB, of the Observatorio Venezolano de Finanzas (Venezuelan Finance Observatory) and private consulting firms warn that foreign currency indexed loans represent important risks, not only for debtors who use those forms of credit, but also for the issuing banks, and the Venezuelan banking system, in general.

IIES: Exchange Crisis Result in Financial Crisis

Regarding debtors and moneylenders, it’s a currency-related risk because if a Venezuelan citizen receives 100,000 dollars today in a year-long credit, while the official exchange rate set by the BCV is currently at Bs. 4.5 per dollar, then the bolivar might lose its value in the next twelve months (to Bs. 9 per dollar, for example), the debtor must then pay the bank when the credit is due, with the new exchange rate, both his capital (which no longer is 450,000 bolivars, but 900,000 bolivars) as well as the interests and flat commission corresponding to the credit plan. As to the creditors, the risk caused by the exchange rates also applies.

In a small economy, open, and with a shallow and non-diverse financial market, if all the debt’s denomination, both financial and non-financial, is in national currency, a depreciation could generate a financial crisis, because of the contractive and redistributive effects the new exchange rates could have on the debtors and bank holders.

“The financial crisis in Venezuela and Mexico during the nineties in the XX century, and the Asian crisis in 1997, are examples of exchange rate crisis which resulted in financial crisis,” warned the Economy PhD Luis Zambrano Sequín, UCAB professor and researcher for the IIES, in the document titled “Riesgo cambiario en el sistema financiero en una economía bimonetaria” (“Exchange rate risks in a bimonetary economy”).

According to Zambrano, indexed loans are the result of internal financial disintermediation and withholding internal credits generated by the monetary and foreign exchange policies in the madurista administration, involves proprietary and solvency dangers for financial institutions in the country, because of the increase of foreign currency holdings—whether or not they issue loans in bolivars or in foreign currency.

The exchange rate risk won’t disappear like magic in economies where financial systems are highly dollarized. In situations like the one we have at the moment, without taking the proper measures and without the needed transparent regulations, major crisis triggers will be unavoidable. Loans in foreign currency will tend to exceed the amount of deposits.

In dollarized economies, and especially in Venezuela, central banks have significant restrictions to carry out their role as last resort lenders and they only have a small influence in the behavior of monetary aggregates. The IIES points out that a wrong diagnosis of the degrees of exposure and the channels through which these risks are taken, are also elements that explain several of the worst financial crisis that have occurred in Latin America. A real dollarization process requires a high amount of international reserves, a robust and sound bank system, healthy public finances and flexible salaries. This is not what happened in Venezuela.

As a consequence of SUDEBAN’s new resolution, all loans are tied to an index unit, therefore, when the currency exchange rate decreases, the credit amount increases, so the taker has to pay more bolivars in face of the devaluation.

“The exchange rate stability which we have seen in the past few months, has benefited those who took out loans during this period of time, because the cost isn’t going up, although it does go against the banks indirectly because they are being paid the same amount while financial costs are increasing,” said economist José Guerra, member of the Observatorio Venezolano de Finanzas (OVF).

According to banking risk qualifier Leonardo Buniak, Venezuela’s reserve requirements (73%) isn’t only the highest in Latin America, where the average doesn’t surpass 14%, but the highest in the world. “Banks couldn’t comply with the 85% reserve requirements imposed by the government in 2021, and that had a financial cost for them of over 125% annually; they are paying a very high fine.” 73% will only be useful to lower financial costs to the banks and improve their profitability, but it won’t allow them to reactivate loans to finance housing, cars, and other products for regular citizens. “This won’t be reflected in large credit to Venezuelans, as the government announced. I’ve talked about this with many banks. There will be zero impact. Credit cards won’t come back, this won’t reactivate foreign currency indexed loans, which are commercial loans, they are very expensive, and are to be handled with a lot of responsibility and care.”

A 75 million dollar boost in loans is but a drip in the ocean of what’s required to recover the levels of productivity we had in 2013. At this rate, considering all the corrections that need to be made, we’re decades away from a healthy financial landscape.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate