Venezuelans Helpless Against Unsparing Hyperinflation

All Venezuelans today, regardless of the currency they handle, are suffering the effects of an imploding economy that displays just how fragile the “privileged” bubbles truly are

Everyone's one push away from economic collapse.

Photo: Sofía Jaimes Barreto

Mrs. Vicenta Balbi just gave up on paying for her internet service.

“Look at this, look at the bill,” she says. “It never worked, so now they’re charging in dollars. But who can pay for this?”

Her internet provider, a private company offering an alternative to the service offered by the state, charges her monthly for both cable TV and internet. Every first day of the month, the bill shows up on her inbox, along with a reminder that, to her, sort of sounds like a threat: “Remember to pay on the first three days of the month, to avoid penalties and service shutdown.”

“Well, they’re gonna cancel my service,” she says. “I understand that inflation makes everything more expensive, but I can’t take price leaps like this. I either buy meat, or I pay for the internet.”

And she’s certainly fuming. After months of a steady (and expected) rise, the fee for the cable-and-internet combo that she normally pays rose by 100% between the months of September and October, without any warning from the cable company. All the planning she had done for the month is useless now—and it’s not only this service that’s becoming harder to pay.

Mrs. Balbi is, for the Venezuelan context, privileged. A middle-class retired woman in her early seventies, she mainly survives on the money her son sends her from London—£50 every couple of weeks, which helps her quite a bit when she turns them into dollars or the official local currency, bolivars. That exchange, though, takes time and it’s exposed to the very unstable (and ruthless) nature of the black market Venezuelan dollar.

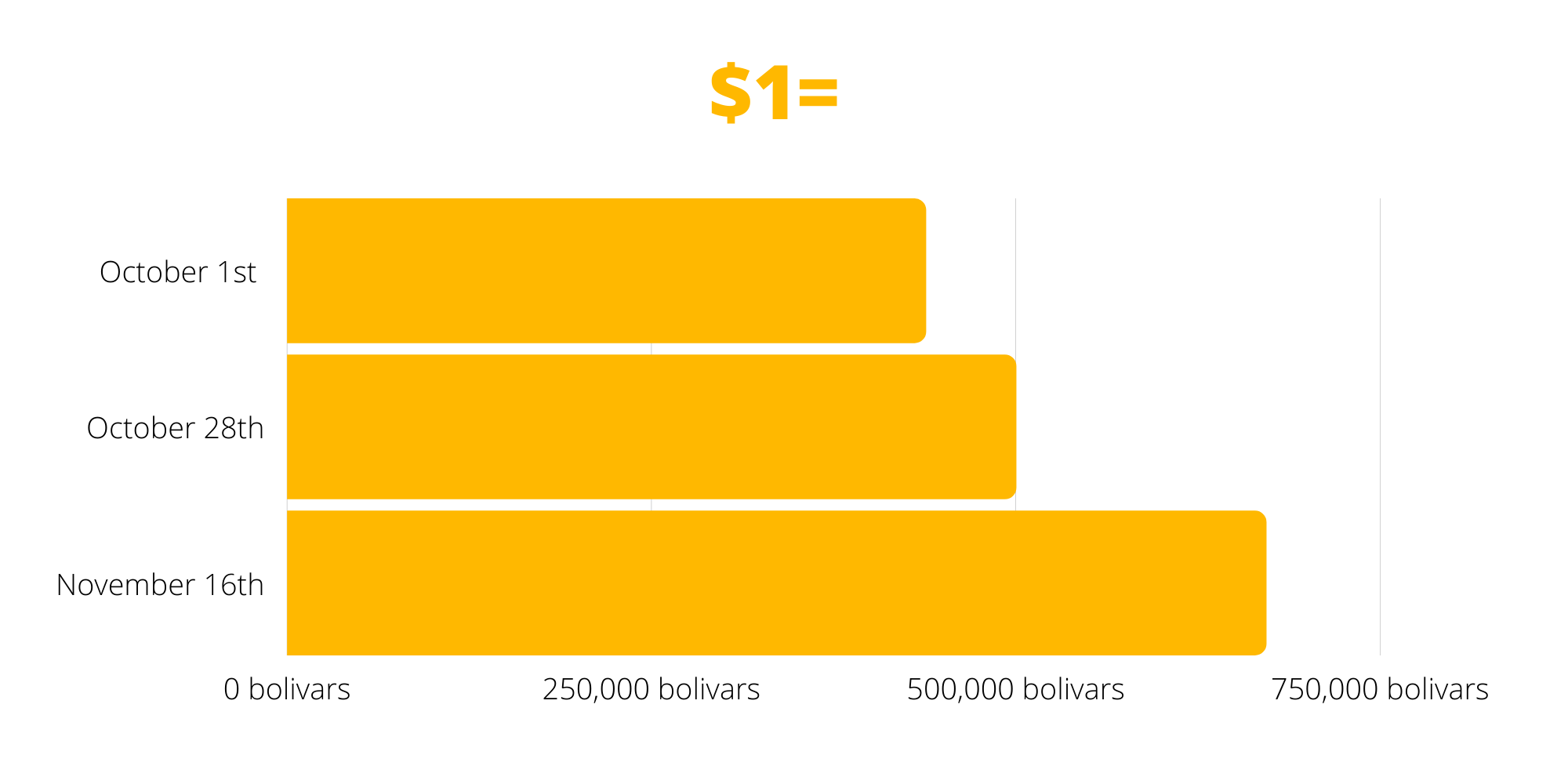

Right now—literally as you read these words—Venezuela is going through a hyperinflationary explosion, already in an out-of-control-inflation context that’s been two years long, so far. A look into Monitor Dólar, one of the most popular websites among Venezuelans tracking the value of goods and services in local currency, will tell you all you need about today’s economic reality.

The difference on the dollar value between October and November means a huge spike of all prices on the street.

Photo: Sofía Jaimes Barreto

This is in a country that rules its economy according to this black market rate while most of the population has no access to hard currency. While many are charging in greenbacks for their work, all public workers (like teachers) are paid in bolivars. The minimum wage, mind you, is 436,140 bolivars—its real value is less than a dollar.

The effects of this savage dynamic are described frankly by Mrs. Balbi.

“Well, I think it’s great that (my cable company) charges in dollars,” she says, “but then they’re gonna have to wait until I get my remittances, and I turn them into bolivars. I’ll first go to the store and buy my medicines and my food, then I have to pay for rent and power. I have to do this as quickly as I can, because a delayed day can be an important difference in prices. Then, if I can, I’ll pay for the internet.”

And listening to her, you can only wonder: What if you don’t get remittances?

A Sick Game of Economic Abuse

“The main feature of the Venezuelan black market, regarding dollars, is the presence of a huge actor (the state) that gets the biggest amount of dollars into the economy although, until very recently, it employed an official exchange rate that was disconnected from reality, with a discretionary selection of who would get cheaper dollars and who wouldn’t—a practice that gave way to the black market distortions and shady businesses we have in Venezuela.”

For Daniel Urdaneta, economist from the Universidad Central de Venezuela, MSc in Economics (Pontificia Universidad Católica de Chile), CFA Charterholder and contributing author at Caracas Chronicles, the savage tides of the Venezuelan economy are explainable through offer-and-demand principles, and what happens when these precepts get distorted.

The basics: In practice, there isn’t a single price of the dollar; there are multiple offers around a reference price and both buyers and sellers have negotiations where the big factor is the urgency that buyers have for dollars (immediacy raises the price).

The evolution of the exchange rate over time is truly about how many bolivars there are flowing in the economy and how many dollars are available for sale in the local market. “In Venezuela,” Urdaneta says, “a savage policy of printing banknotes began as a way for the government to deal with fiscal deficit—the Central Bank prints money to satisfy debts.

“These particular explosions of the black market dollar in short time spans come as a consequence of the government moving from a fantasy exchange rate to one that’s much more closer to the black market rate. They realized that if you raise the price of the dollar, you can earn more bolivars to help you cover the deficit. But when PDVSA has debts and no bolivars to satisfy them, it’s back to the money-printing machine.”

These particular explosions of the black market dollar in short time spans come as a consequence of the government moving from a fantasy exchange rate to one that’s much more closer to the black market rate.

This is a lot of money that enters PDVSA and is then used to pay contractors and other associates, who are getting a lot of bolivars with little value by themselves. “The contractors end up buying dollars with this money, and that’s a hard pressure they’re applying on the dollar price.”

Urdaneta paints the picture of an economy susceptible to abuse: “This is amplified when you have individuals with privileged information on when these bolivar payments will be done and when there will be a peak in dollar demand, so they strategically diminish the dollars offered at the right time. The result is a savage spike on the dollar price. Whenever these spikes happen, the market eventually reestablishes itself after the possibility of pushing buyers disappears. It’s a cycle that repeats itself again and again.”

For Urdaneta, hyperinflation in Venezuela comes down to three points:

“The local offers of good and services went to hell after years of price controls and expropriations, and the Dutch disease—a lesser offer means higher prices; then you have over ten years of chavismo spending way more than what it gets, and just printing money to cover the gap; then there’s the crash of oil prices of 2014, and a Venezuela isolating itself away from the rest of the world—all of this predates the American sanctions, by the way.”

A Very Fragile Bubble

The theory and the details just described are a bit away from Melissa Azuaje*, a 31-year-old working in customer service for a gambling site on the internet.

Melissa describes herself as part of the precious “bubble,” those Venezuelans with a steady supply of hard currency that gives way to exclusive options in day-to-day Venezuela. Her wage of $250 comes once a month, and in bitcoins.

“I have to exchange those for bolivars and dollars,” she says, “although getting dollars has gotten hard recently. 2020 has complicated things, because my mom is the typical housewife and my dad, who used to work at the restaurant of a Caracas hotel, has gone out of a job ever since the quarantine began in March. So now I take care of myself and my parents. Almost all of my money goes away in food.”

“We have the pension money that my parents get, that isn’t much, but it’s a tiny push at the store. But if I have to buy something for myself, money is taken away from our food budget.”

A resident of middle-class Bello Monte, in Caracas, Melissa says she usually surfs the Venezuelan economy with more or less skill, working in a trade that’s almost untouched by the lockdown measures (even before the quarantine, she worked from home).

The spikes of the dollar and their direct effect on the inflation are throwing a wrench on her personal economy, where “you have your spending all planned out, and tomorrow the inflation screws everything up.”

“The food I can afford right now isn’t even all of the food we need,” she says. “We have the pension money that my parents get, that isn’t much, but it’s a tiny push at the store. But if I have to buy something for myself, money is taken away from our food budget—although I do buy things for myself. Sometimes you just have no choice. I just bought new glasses, for example, which is something I needed. That purchase took away from expenditures on food and services, particularly now.”

So how can you consider yourself in a bubble?

“Well, I live in a good place, and I can buy meat, which many people can’t—my neighbor, for example, buys meat occasionally and he makes do with what he can. I can pay for the services. When the month is ending, I do feel the strain, but this year has been very mean on most Venezuelans, and I’ve been able to do okay. Last month, I bought several things I needed—underwear, nail polish, an iron, stuff that people may criticize, but I refuse to see all my money go on food. Most people out there can’t allow themselves the luxury of buying toys for their nephews for next Christmas, you know?”

Venezuelans today live in a reality of a predictable (disillusioned) political arena, and a completely anarchic, unforeseeable economy. The apparent stability that the nation experienced in the last couple of months of 2019 are a bitter memory while prices soar from a day to the next, punishing everyone but the most privileged among the privileged. And it’s all happening at once: citizens don’t know when the next power cut is going to be (or how long it’ll last), whether their next paycheck will be enough to cover for basic food items, or what they’ll do if the somewhat distant promise of coronavirus becomes a sore emergency. Right now, for example, there’s another shortage of fuel across the country and nobody to tell when the lines at gas stations will end.

There’s an evident wrongdoer, apparently indifferent to the woes on the street.

“That narrative of how the black market dollar is controlled in Venezuela by a bunch of guys at a Home Depot or a club of oligarchic businessmen doesn’t stand the minimum smell test,” Urdaneta says. “Who brings the dollars in and decides their price of sale and even the buyers of those dollars, if not the government?”

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate