Why We’re Innovating in the Venezuelan Blockchain Space

Despite the economic crisis in Venezuela, there’s one sector where business is booming: cryptocurrencies. From mining to exchanges, Venezuelans are finding ways to make a living around a new technology that’s on its way to mainstream adoption.

Photo: Criptonoticias

Facing 4,000% annual inflation and a currency that has lost 90% of its value over the last 12 months, Venezuelans are watching their savings evaporate. The largest banknote (Bs. 100,000) represents some $0.40. Due to limited penetration of electronic payments, Venezuelans are paying premiums of up to 100% to get paper bolivars for services like gasoline. With cash shortages, banks limit withdrawals at their ATMS to a lot less than $1 per day.

There is, however, some hope to fight hyperinflation: bitcoin.

One of bitcoin’s unique attributes is that, instead of being issued by a government or central bank, it’s run by an open network of people around the world that validate transactions and adhere to certain rules — only 21 million bitcoin are to be issued, for example. In this decentralized network without intermediaries, a bank account is not required: to buy bitcoin, you only need an internet connection and someone willing to sell.

It’s hard to appreciate these values when you live in a developed country with a stable currency. For a typical person in the U.S., bitcoin is no more than a speculative instrument, but put yourself in the shoes of a Venezuelan who has to carry a bag of cash to pay for a haircut. A monetary good not controlled by a government, that guarantees a low inflation rate is seriously attractive.

This is why many leaders in the cryptocurrency space expect that some of the strongest uses for cryptocurrencies (worth noting that we don’t see the Petro as such, since it’s issued by a government) will be seen in countries with extremely low trust for governments and institutions. The founder of Ethereum, the second most valuable cryptocurrency, tweeted:

How many Venezuelans have actually been protected by us from hyperinflation?

— Vitalik “Not giving away ETH” Buterin (@VitalikButerin) 13 december 2017

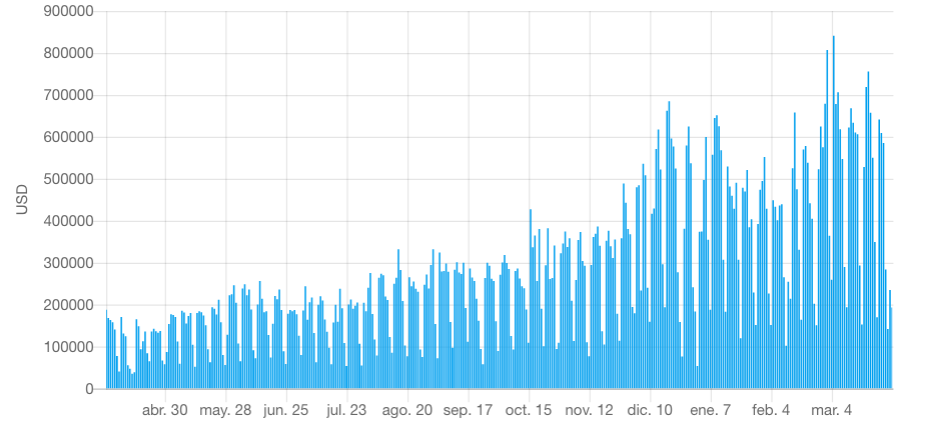

It’s still unclear how many people in Venezuela have been protected from hyperinflation by bitcoin. What is clear is that Venezuelans have demonstrated a growing appetite for it: the graph below shows daily volume of bitcoin purchased with bolivars in localbitcoins.com over the last 12 months, expressed in USD:

Every week, Venezuelans purchase 3.7MM USD worth of bitcoin with bolivars. That’s a +362% increase from 800K USD 12 months ago. During the same time period, the bitcoin exchange rate in bolivars increased by +52,249% (a multiple of 523X).

Venezuelans are also going beyond buying bitcoin, earning it through mining. Given that electricity represents the largest cost to mine bitcoin, and that electricity in Venezuela is extremely inexpensive, Venezuela happens to be the cheapest place in the world to mine.

Some are selling their assets in bolivars (we know of someone who liquidated all his savings, while someone else sold his car) to acquire mining equipment. Most do so at a small scale, buying enough machines to generate a few hundred dollars a month. In a country with a minimum monthly wage of $6, that gets you quite far.

But it still is a risky business. Although the government recently legalized mining activity through the creation of the Blockchain Observatory (which requires miners to register on a list), not everyone is jumping in right away. Venezuelan miners have operated in secrecy for years, and there are stories of the police using intelligence to monitor electric power consumption to figure out who is mining, to raid homes and confiscate their equipment.

But as the Venezuelan economy collapses, the cryptocurrency mining space is booming and new services are flourishing. Tech savvy Venezuelans earn bitcoin by installing mining rigs for others, while local chat groups are active with entrepreneurs offering to sell hardware they sourced abroad.

With an increasing number of exchanges, we saw a need to build VeneBloc — a site that aggregates real time transactions and volume across cryptocurrency markets in Venezuela, hoping it turns into one of many tools entrepreneurs come up with to move Venezuela forward and build a new industry from the ground up.

Bitcoin and other cryptocurrencies still have a lot to prove. They are highly volatile and have only been around for less than a decade. But in a country with few economic opportunities, they bring excitement and hope to a generation of youngsters looking to make a difference and see their country progress.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate