Everybody Wants a Piece of CITGO

PDVSA bondholders, US energy firms, the Russians, Crystallex, and now a Swiss commodities trader… everybody wants dibs on CITGO, the most valuable Venezuelan asset abroad.

Photo: Boston Herald Radio

The Venny bond market is a hell of a mess, from long before Maduro caught the bulls with their pants down. Dig deep beyond the pile of worthless junk issued by the Republic and PDVSA, however, and you might strike gold: bonds backed by CITGO Holding, Inc. are still paid on schedule.

That’s because if you stop paying, the most valuable resource of the nation held abroad will fall prey to a swarm of vultures that has never stopped growing, pitted against each other for dibs on the only hard asset left in Venezuela, after years of pawning off La Patria.

Last year we digged deep into the matter. The short version goes like this:

PDVSA owns CITGO since the early 90s. The company is a critical part of the nation’s oil business, due to its huge refining capacity specialized in extra-heavy crude, used to process almost 800 thousand barrels a day for the United States, Venezuela’s most important trading partner.

Since the fall of oil prices in 2014 (or a few years before, depending on who you ask), PDVSA has been borrowing money to pay old debts at an unsustainable clip.

When no buyers of PDVSA bonds were left, chavismo started pawning Citgo assets, through collateralized bond sales, building a house of cards — or rather, a pyramid of cards.

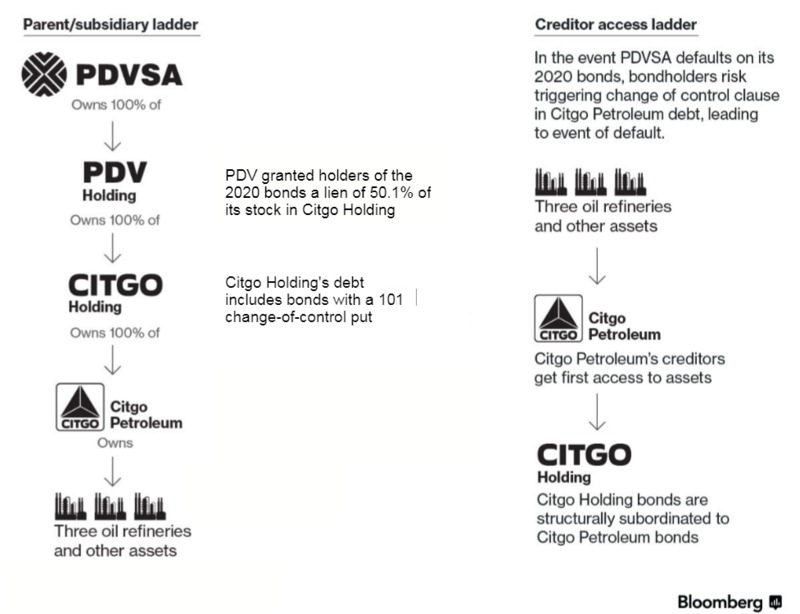

Credits to Bloomberg and their superb infographics:

Layer One: Citgo Petroleum

Bond: CITPET 6% 2022

What’s in it: USD 600mm issue, backed by the company’s equity. This is the juiciest part of the structure, since it has a priority interest over the three refineries Venezuela holds in the US: Lemont, IL, Lake Charles, LA, and Corpus Christi, TX. Competitors are salivating and have been trying to buy them for years.

What’s the trigger?: If CITGO stops paying the coupons due, bondholders can assemble and direct a liquidation of the company to satisfy their claim. There’s still very little incentive, since payments are made several months in advance to an escrow account, and the process still works like clockwork. Besides, the 600 million owed pale in comparison to even the most conservative valuations of the refinery system.

Layer Two: CITGO Holding, Inc.

Bond: CITHOL 10% 2020

What’s in it: USD 1.5Bn bond, backed by the residual value of Citgo Petroleum. Beyond owning CITPET whole, the holding indirectly owns the terminals network and pipelines connecting the refineries to the U.S. grid. There’s still a lot of valuable stuff backing this Layer.

What’s the trigger?: There are two possible outcomes. First, and just like Citgo Petroleum, CITHOL bond coupons are being paid on time… until they aren’t anymore, in which case the whole holding company would be at the mercy of holders. Second, there’s a change of control clause: if PDV Holding, Inc. (current owner of 100% of Citgo Holding’s equity) were to dispose of its stake, the new buyer would have to pay CITHOL bondholders the amount due immediately, at 101% of face value. Since the bond is currently trading at close to 105% of par, the market doesn’t look scared of an imminent seizure.

Layer Three: PDVSA (through PDV Holding, Inc.)

Bond: PDVSA 8.5% 2020

What’s in it: USD 2.5Bn bond, backed by a majority equity stake on Citgo Holding, Inc. Here’s when things get interesting: PDVSA 2020 bondholders own 50.1% of CITHOL —net of Layers One and Two—, and they don’t, at the same time. It’s a collateral for legal purposes, and there’s no change of control as long as the bonds get paid on schedule.

What’s the trigger?: The transfer of shares would only take place if bonds defaulted, and a critical mass (25% of holders) initiated a legal procedure to attach the shares. The first principal payment due (last October) was one of the last authorized by Maduro before shutting down the Venny bond party, so the Citgo Holding share disposal wasn’t triggered amid the Difol. There haven’t been any cross-acceleration triggers either; unsecured PDVSA holders are waiting to see if the December 2017 tweets about coupon payments materialize. Wishful thinking to the max.

Layer Three-and-a-half: PDVSA (through… Who knows?)

Bond: Rather than a bond, it’s a USD 1.5Bn private loan with Rosneft, the Russian oil giant.

What’s in it?: The loan is backed by the remaining 49.9% equity of Citgo Holding, representing a contingent minority interest of the company in a whole block, instead of a majority stake distributed among multiple holders (which is the case with Layer Three).

What’s the trigger?: Just as PDVSA 2020s, if the oil company fails to fulfill the terms of the debt, the 49.9% stake goes to Rosneft. This has been a concern with U.S. legislators, fearing national security risks over a Russian company owning a critical piece of their oil infrastructure. The deal is much different than on Layer Three; it’s a private loan, so only Rosneft knows whether PDVSA is still paying back. In fact, talks were held last year between both companies to divest the collateral and get rid of the potential geopolitical mess.

The talks went nowhere, but the plot thickens.

We want CITGO, and we want it NOW

Two major players are trying to outsmart the owners of the PDVSA-CITGO pyramid.

The first one is Crystallex, a Canadian mining firm that operated in Venezuela until its expropriation in 2008; the firm has established a legal battle to recover its losses, seeking to reclaim the damages by seizing Citgo Holding, as the only asset worth attaching to.

Their argument is based on “fraudulent transfer”: the idea that PDVSA willingly and systematically pawned every single asset held abroad, so creditors such as Crystallex wouldn’t have a way of recovering money. They haven’t been successful: their latest setback came earlier this year, when a U.S. court ruled that the plaintiff hasn’t proved that the state oil company is an “Alter Ego” of the Venezuelan Republic and, thus, an entity within reach of its lawsuit. For the time being, it appears that Crystallex will not get a hold of CITGO.

The second player came to the surface just a few days ago, and seems better positioned to snatch the crown jewel. It’s Swiss-based commodity trading firm Mercuria, which asked the U.S. Treasury for a licence to deal with Rosneft and PDVSA.

Mercuria’s plan makes a lot of sense at first sight: the company currently has an oil supply deal with CITGO and a financial interest in keeping the company viable, with or without PDVSA. Any chance of a diplomatic tussle between Moscow and the White House over ownership of CITGO could be avoided like this. Igor Sechin, Rosneft’s CEO, has been quoted saying that getting rid of the collateral (and all its problems) would be ideal for them and a Mercuria rep cheerfully said that “This is a private sector solution to a public policy problem”.

But is this a solution for PDVSA?

Something’s gotta give

Many things don’t add up. The fact that Rosneft is so eager to dump the CITGO collateral is a red flag: it could mean that the Kremlin, Maduro’s only remaining financial ally, won’t extend more credit to the nation. Remember China is also reluctant to give out new loans (“They can handle their own affairs”), not renewing any credit lines since at least 2015 (most likely due to Venezuela falling behind). This greatly increases the risk of PDVSA failing to keep current on the payments of their 2020 bonds; add a sanctions regime that has Maduro cut off from the dollar-based financial system, and a full-blown default on Layer Three is all but assured somewhere in 2018.

The mechanics of a Difol on the PDVSA 2020s are tricky. Let’s assume that, in effect, the bonds get unpaid and a 25% bondholder committee moves to execute the collateral. The bond indenture isn’t clear on the process, but it would require auctioning off the 50.1% equity interest to the highest bidder in a single block sale, with the proceeds distributed amongst holders of the 2020s. That means that everybody could buy a majority stake, not just Crystallex, Mercuria, or U.S.-based refiners. Perhaps some specialized Private Equity firms are looking into this and salivating over prospects.

What’s certain is that Venezuela will most likely lose CITGO for good, and all it got in return was an extra couple years of Maduro in power.

Talk about shitty deals.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate