Schrödinger's Default

This morning, Electricidad de Caracas’s 2018 bond went into default...or did it?

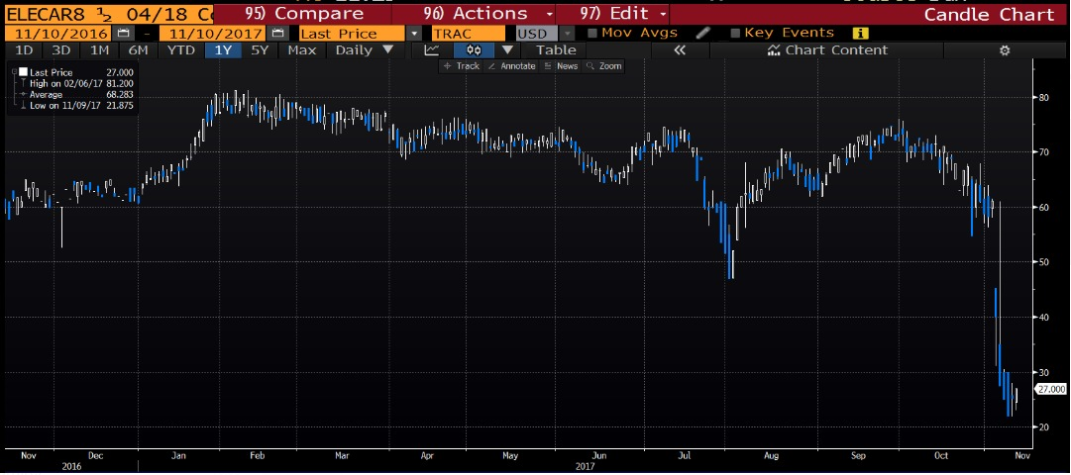

Yesterday, the grace period over the last coupon of Electricidad de Caracas bonds (ELECAR 8,5% 2018) lapsed. The paying agent had seen no money, so the bonds were declared in default by the trustee, Wilmington Trust, as of this morning.

“This is it”, many market agents and journalists said.

“R.I.P. Elecar”, others whispered (including me).

Even over at Zero Hedge, the headline was “Venezuela Officially Declared In Default,” which was definitely the wrong thing to say in the beginning because there’s no cross-default between Elecar and any other bonds — Venezuela bonds or PDVSA or anything else. Either way, a default on the ELECAR 18s was widely expected by the market ever since Maduro starred in Empanada-Gate, the most tropicalmierda declaration of a restructuring/reprofiling/default/credit-soap-opera of all time.

It’s a kind of inside information festival out there right now.Investors spent all week scrambling to position themselves for the following scenario: the government would decide to pay PDVSA bonds in arrears (as late as legally viable), and sacrifice ELECAR. The next question was if they were going to do the same with Sovereign bonds next week.

The bonds had plummeted to historic lows following Maduro’s non-default default announcement eight days ago. After trading in 60-80 territory for the last twelve months, ELECAR fell off a cliff as soon as Maduro spoke. The climax of ELECAR-geddon came this morning as the default notice started to make the rounds in the market. Broker-dealers aggressively lowered their bids (I heard somebody was bidding just 1 cent on the dollar, and TRACE reported some 8 million face value in several trades below 25 cents.) The vultures were ready to jump.

And then, just after lunch, this:

Transferidos a las instituciones financieras el 08/11, los recursos correspondientes al pago EDC2018 (8,5% Notes due 2018). Cambios en la operatividad han afectado las transacciones. @LMOTTAD

— CORPOELEC Informa (@CORPOELECinfo) November 10, 2017

“Funds corresponding to the payment of EDC2018 (8,5% Notes due 2018) were transferred on November 08th. Operational issues affected the payment.”

Are you kidding me? Seriously?

Are they telling us they paid two days ago, and decided to tell us about it only today, after the notice of default by the trustee?

Why didn’t they say anything on Wednesday? What the shit?

The trouble isn’t just all the chaos the government causes by not paying or paying late. The problem is also that their communications are so opaque markets don’t know what to think. Administrative chaos + chavista opacity make for a horribly dangerous “strategy” that could wind up setting off a messy default and the harshest legal battle of our country’s history.

What’s for sure is that the more opaque the market is, the bigger the profit opportunities for the select few with an inside line to what the government plans to do. It’s a kind of inside information festival out there right now. While normal bondholders sweat and normal Venezuelans go hungry, people in the know must be making off like bandits.

So yeah, Quico. I’ll go foroption A.

Sube el telon:

Elecar no paga un cupón a tiempo, es declarada en Default.

Baja el telón.Sube el telon:

Colapsan los precios de los bonos elecar.

Baja el telón.Sube el telon:

Corpoelec anuncia que *claro* que sí pagó el cupón.

Baja el Telón.¿Como se llama la obra?

— Francisco Toro (@QuicoToro) November 10, 2017

Diosdado just got a new yacht.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate