A Bondholder's Nightmare

The days of crying wolf are over and the Venezuelan default is pretty much here. With such clear signs, why did it find everyone with their pants down?

Cross-posted on Shawn’s blog, Macro-Man.

“The time between the “outrageous” and “yeah, you didn’t know that?” can be incredibly short.”

This tweet was about the Hollywood harassment scandal, but it applies to markets on a regular basis – and it certainly did in Venezuela last week.

Intrigue surrounded the amortization and maturity of two PDVSA bonds, which required roughly $2 billion for bondholders. Sanctions preventing US dollar transactions and new US dollar funding for the regime complicated the already difficult task of cobbling together payments with an absolutely broke government.

And yet… it paid.

PDVSA somehow bundled the October 28th amortization payment across the line, and promised, with some credibility, that the check would be in the mail for the maturity of the PDVSA bond of November 2nd.

Then, one of the more surreal events in the history of sovereign defaults happened: after market hours on Thursday evening, Maduro announced that the government will stop paying principal and interest on the current debt load, the same day they pledged to pay back a bond at par. And what had been a tumultuous but profitable week for Venezuela bondholders, turned into a total nightmare.

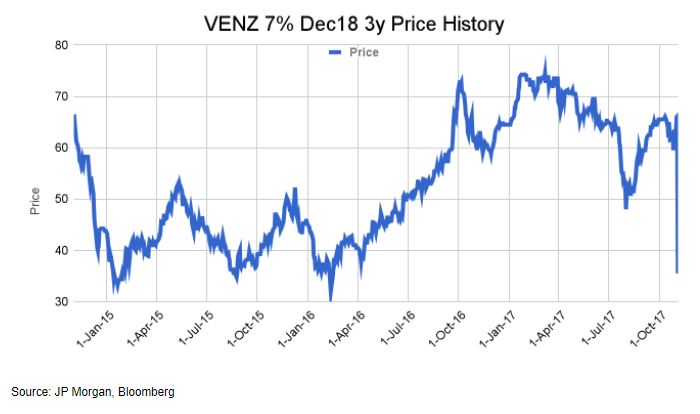

The 7% December 2018 bond saw its value cut in half from the high 60s Thursday afternoon, to the mid 30s on Friday, just above what many people use as assumption of what defaulted sovereign debt is worth in a restructuring.

With the wave of Maduro‘s magic wand, “Venezuelan default” went from “outrageous” to “yeah, you didn‘t know that?”

Here‘s where “macro” comes in. Those who’ve been following me for the last few months know that I have a healthy skepticism of macro trading strategies. There are traders out there who are constantly ahead of the curve, who see opportunities more quickly and accurately than the rest of the crowd, even in markets they don‘t trade in every day. But for the vast majority of the universe, there has to be a definable edge when you are doing something the rest isn‘t, whether it’s a different type of analysis, or taking advantage of some market breakdown or regulatory change.

The different pools of capital in financial markets should produce enough diversity to keep markets “honest” in the same way Leo Messi keeps defenders “honest” because they have to protect against him charging to the goal or threading a brilliant pass to a teammate. You can’t “cheat” towards one or the other because you’ll pay for it.

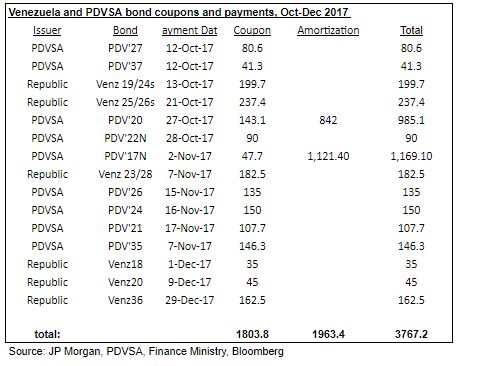

How did markets miss that Venezuela could default any day? Did they miss out on this chart, which shows nearly $4bn in payments going out the door in Q4 2017, for a country with stated foreign reserves of $10bn?

A few months ago, I talked to some EM managers on the subject. One suspects that “(debt holders) are going to start bailing when it’s too late, ourselves included. Anyone that has anything to do with an index gets burned by being underweight, so they inevitably come back. To step out of the position, you would have to compensate, and there isn’t enough risk-adjusted yield to do so elsewhere.”

That’s the “cheat”; for bondholders, Venny debt was a case study of game theory in Emerging Markets. The market structure is set up in such a way that the biggest foreign investors were afraid to sell and afraid to buy. Macro investors should step in and say “Look, the market is pricing a greater than even chance 2018 bonds will be paid at par. There’s nearly $4bn in bond payments this year, another $10bn next year, versus $10bn in foreign reserves at best, for a country under sanctions that prevent access to new dollar funding.”

Why didn’t they? There’s a few reasons:

- The capacity of repo markets to lend bonds has been greatly curtailed. After the post- Global Financial Crisis reforms, banks don’t want the risk of lending bonds in a credit on the edge of default. This situation leads to a lot of difficulty in trying to establish a sizeable short position in the bonds, and when you can, it can be prohibitively expensive;

- The size and risk appetite of global macro has been overwhelmed by the size of real money investors. The days of George Soros pushing around markets and central banks are over; enter the era of the multi-trillion-dollar passive asset managers such as Blackrock, Vanguard, Fidelity, etc.

- The liquidity provided by Wall Street banks seized up further when the US imposed sanctions on USD transactions with the regime. A couple key players in the interdealer “wholesale” market stepped out after the August round of sanctions, worsening market liquidity and amplifying the wild swings Venny Bonds are known for.

- Call it what you will, self-preservation, or the Bachaquero on Wall Street trade, but guessing the date of the Venezuelan default has been a trader parlor game for over three years now — more than one hedge fund trader got carried out on the short Venny theme. Traders were lulled into complacency that Maduro would simply find a way. He didn’t.

With macro traders sidelined and real money investors petrified, liquidity dried up and the market became hostage of local brokers and regime insiders, rather than economics and risk. A break that macro traders were unable to exploit… and Venezuelans couldn’t prepare against. It is yet another testament to the power of market efficiency, and the consequences when it breaks down.

The losers in this game? Not the regime, the fixed income investors or even the hedge fund guys that shorted Venny too early: the real losers were the Venezuelans who died because there weren’t enough dollars to service the debt and import food and medicine.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate