31,109 Bolívares for a Dolar, Today

The dollar doubles to 31,000 in less than two months – textbook late Voodoo Populism.

Original art by Mario Dávila

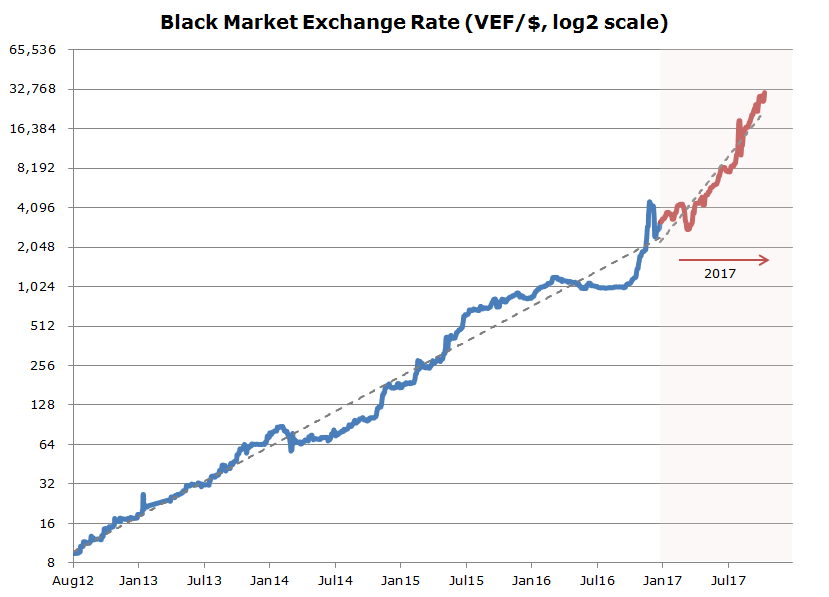

The price of a dollar hit 31,109 VEF/$ today, up from three thousand VEF/$ this January. That’s another zero on the exchange rate in 10 months. The growth since 2013 has been so explosive you have to graph it in logarithmic scale to even see anything:

Look at the graph’s vertical axis. The numbers don’t increase by some fixed amount each step, they double. The line gets steeper in 2017 because the exchange rate is now doubling every three months on average, about twice as often as during the four years from 2013 to 2016. This is genuine exponential growth, and if the 2017 trend sticks, the exchange rate could climb to 60,000 VEF/$ by year-end and 120,000 by April 2018.

It’s depressing but hardly surprising. In this late stage of voodoo populism, Venezuela’s central bank (BCV) creates trillions of bolívares from thin air every month to cover the government’s fiscal deficit. So every month, the economy is flooded by a tsunami of new bolívares that chases the same supply of goods and dollars, causing soaring inflation and washing away some large fraction of everyone’s bolivar holdings. That’s why Venezuelans rush to buy canned tuna, car batteries or anything else with durable value if they have leftover money.

As it happens, this is a dangerous and unstable monetary equilibrium. On one hand, the bolivar’s value is falling closer and closer to zero as government dilutes the currency and collapses demand for local money. On the other, to get the same spending power from BCV’s printing press, the government is having to mint more and more currency every month to compensate for the lower and lower value of the bolivar.

It’s a terrible feedback loop. Maduro is growing the money supply by 750% a year because the value of the local currency has cratered 83% in real terms and 97% in dollars since 2012. And as long as it keeps falling, he’ll have to print more.

This is genuine exponential growth, and if the 2017 trend sticks, the exchange rate could climb to 60,000 VEF/$ by year-end and 120,000 by April 2018.

The regime backed itself into this corner by refusing to rationalize policy. Instead of entering an IMF program to get the house in order, Maduro gutted imports 80% to keep paying external debt and caused the deepest recession in Latin American history. Imports fell so severely that the private sector was wiped out and the economy hung out to dry. It’s no surprise real tax collections have fallen 70% since 2014 and that Maduro’s now scrambling to plug the resulting deficit with BCV’s printing press.

But here’s the thing about the printing press: after a certain point, governments actually get less real money by printing more nominal money. There’s a limit to how much the regime can siphon from the economy, and after that limit, the printing press backfires and only causes explosive inflation. Tragically, most governments react to this by printing yet more money, which only makes the overshooting worse.

If the regime hasn’t crossed that line already, it will soon. BCV printed over 5 trillion bolívares in September (29% of base money or 300% of tax collections) to finance Sunday’s regional elections and Christmas spending is right around the corner.

This textbook disequilibrium tends not just to high inflation but to high and accelerating inflation. And at some point, higher and higher inflation can spin out of control into bona fide Zimbabwean hyperinflation. Prices rose 36% in September and are up something like 900% against last year, so Venezuela is right on track to hit 1000% inflation this month or next and 50% a month sometime next year. Those are two common thresholds for hyperinflation, i.e., the danger zone.

BCV printed over 5 trillion bolívares in September (29% of base money or 300% of tax collections) to finance Sunday’s regional elections.

This is serious. Straight hyperinflation is to the economy what “Little Boy” was to Hiroshima – a nuke. Hyperinflation razes banks and the financial system to the ground, reducing the real value of all deposits and loans to zero. It forces some or all of the economy to dollarize with dollars it doesn’t have, or worse, it makes people barter. Hyperinflation rips supply chains apart and disrupts business in the extreme. It’s a nightmare for everyone, but especially for people without bank accounts and the poor. Whatever Venezuela’s got now, hyperinflation is worse. Believe me.

It’s not too late to do something. Maduro could always resign, appoint ministers that aren’t criminally incompetent, or stop selling 80% of PDVSA’s dollars for 0.03% of their market value (10 VEF/$) to ghost companies and sell them for 100% of their value to real companies instead.

If PDVSA sold its dollar surplus (however small) at market value, it would raise a boatload of bolívares for the government and replace some significant fraction of the currency BCV mints from thin air. That’s why a devaluation could paradoxically slow inflation and the exchange rate’s explosive growth, even though many “controlled” prices would adjust upwards at first. A single dollar fetches 31,000 bolívares right now, so it might not take that much FX to stabilize things.

Or maybe it is too late to do anything. Maybe confidence in the currency has been flushed too far down the toilet. I don’t know.

In any case, Venezuela is edging closer and closer to hyperinflation and the regime hasn’t even acknowledged the problem, much less come up with a plan to address it. They’re either asleep at the wheel or happy with the status quo where Venezuelans are too poor and too tired to protest. This is a catastrophe waiting to happen, as if Venezuela needed another.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate