One million percent later

The price of a dollar is now one million percent higher in bolivars than the day Hugo Chávez was sworn in! Hay Patria!

The day was February 2nd, 1999. And a dollar cost 576 bolivares… of the old kind. Today, eighteen years later, as Venezuela reels from hunger and collapse and oppression, that price is over 1,000,000% higher.

That’s a one with six zeros: One. Million. Percent.

In February 1999, the exchange rate was 0.576 BsF/$. Chavez hadn’t wiped three zeros off the currency then, so it was 576 Bs/$. Well, a dollar now costs just under six million of those old bolivares (or 5,800 of the new ones). Divide the current rate by the 1999 rate, add two zeros and a % sign and see for yourself. The nominal exchange rate is up over a million percent.

In February 1999, the exchange rate was 0.576 BsF/$. Chavez hadn’t wiped three zeros off the currency then, so it was 576 Bs/$. Well, a dollar now costs just under six million of those old bolivares (or 5,800 of the new ones). Divide the current rate by the 1999 rate, add two zeros and a % sign and see for yourself. The nominal exchange rate is up over a million percent.

The number itself isn’t economically significant. It’s just a billboard on the long road to hyperinflation that reads “YOUR CURRENCY FAILED.” But it’s a good occasion to remember that el galactico wiped out 97.3% of the Bolivar’s value. It’s a good occasion to remember that every year for 14 years straight, from 1999 until Chavez’s death, the currency lost 23% of its value on average and it cost Venezuelans 29% more bolivares to buy dollars.

It’s also a good moment to keep tabs on Maduro. In just four years, Maduro erased 99.6% of the Bolivar’s value, or what remained of it after Chavez anyways. Every year, from 2013 to present, he wiped out a staggering three quarters of the currency’s value on average, meaning it cost Venezuelans about 300% more bolivares to buy dollars every year. After eighteen years of XXI Century Socialism, literally 99.99% of the currency’s value is gone.

On days like today, you really wonder in just which level of Dante’s inferno imbeciles like this one belong:

Alfredo Serrano: La emisión monetaria no es significativa en la formación de precios https://t.co/bo2WbsooNU

— Crónica.Uno (@CronicaUno) May 5, 2017

Serrano: if printing money doesn’t cause price inflation, why dont Central Banks just end world poverty with direct cash transfers to all poor people? If printing money doesn’t weaken the currency, why do governments bother to issue debt and collect taxes instead of just printing money and spending it?

Because it doesn’t work like that. Because basic economic laws like “printing phony money causes inflation” apply everywhere, including communism.

Central to the Hugo Chavez’s mission statement was this promise to screw the rich in the name of the poor. But absurdly, printing money did and does just the opposite. At its core, deficit monetization is a deeply regressive inflation tax. Economists have known for ages that it’s a wealth transfer to government and anyone with local debt, mostly big business and rich people, paid for by everybody else, especially the poor.

How? Take an example from a friend.

Back in 2010 when the exchange rate was 8 BsF/$, he loaded up his business with debt, mortgaged his house and used the bolivares to buy $600k on the black market. He sat on the dollars and waited for the black market rate to weaken, as it obviously would, given the government’s insistence on monetizing the deficit.

By 2014, his dollars were worth ten times as many bolivares at 80 BsF/$, the new black market rate. So he sold just 10% of his $600k and paid off all of his debts in bolivares, and sold another $40k to pay the interest he owed on the loans. And voila, he pocketed $500k or enough for a free house in Miami.

Except it wasn’t free.

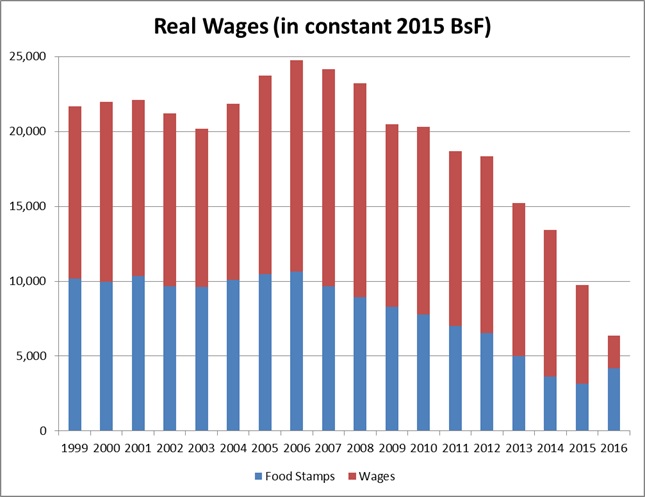

The rest of the country paid for it, mostly by taking a cut to their real wages. The single mom that was making 200 bucks a month and is now struggling to get by on $50 or $30 a month, she’s the one who paid. Here’s a graph of her paying, starting 2006 and 2009, when Chavez killed central bank independence:

But the inflation tax has pro-rich, anti-poor distributive effects that do the exact opposite of chavismo’s robin hood mission statement.

To be clear, the culprit here is the government, not the folks that bet against (or “short”) the currency. But the inflation tax has pro-rich, anti-poor distributive effects that do the exact opposite of chavismo’s robin hood mission statement.

The real story is that deficit monetization in Venezuela is a massive, 5-15% of GDP wealth transfer from the millions of people who work their asses off every day to the parasites in government. The real story is that when government prints money, it usurps purchasing power from all Venezuelans and funnels it to sycophants on the public sector payroll and uses it to keep its bankrupt nationalized industries afloat.

Yes, the government steals poor people’s purchasing power to buy paramilitary groups and fund food programs that function as blackmail. Yes, the government eats away at Venezuelan salaries and savings to close the hole in state finances that gifting 93% of PDVSA’s dollars to cronys opens.

The outrage is not just that the regime loots Venezuelans for 5-15% of GDP every year by diluting their old money with new, but that it does so to fund an ass-a-nine economic system and an extremely corrupt budget. Well fuck that.

If there are any folks on the left trying to find a silver lining here, some “logros” for the Revolution: sorry, there aren’t any. The “gains” were fictional, but the dictatorial backslide, the economic collapse, the hunger and the dead protesters —those are terrifyingly real.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate