“We’re Rich!” and Other Myths

The Petrocéntrico view that specializing on oil will make us rich is both wrong and dangerous. If we're serious about development, diversification is not a tarea we get to just skip.

Doyin Ajala plays inside an oil drum at the waterfront in Lagos, Nigeria Friday, Oct. 17, 2008. More than 100 countries planned World Poverty Day events Friday to encourage action towards United Nations goals for cutting poverty and improving health care and education for the world's poor. (AP Photo/Sunday Alamba)

Everybody knows that Venezuela is and will always be a Petrostate. It’s our destiny: the road to development consists of aggressive exploitation of our oil resources. In fact, why even bother with anything else? Cuando uno tiene esta cantidad de petróleo, mejor te especializas en tu ventaja comparativa. Right?

What are we talking about, when we’re talking about oil riches?

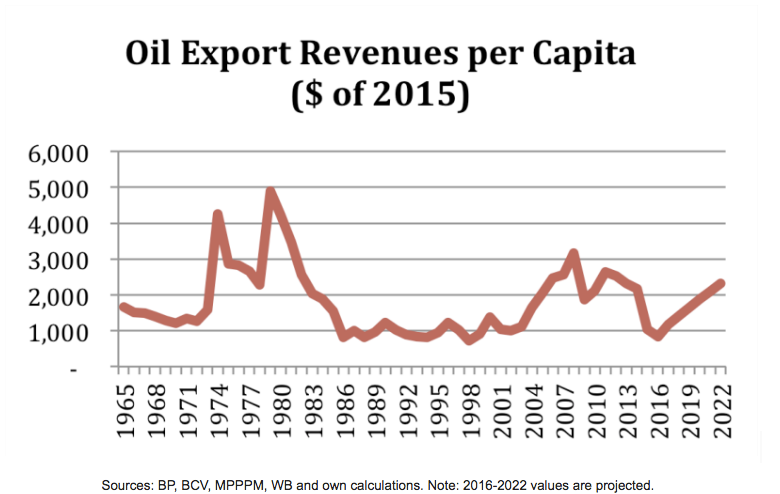

Let’s look at some numbers: Assuming oil prices and domestic consumption remain steady, the herculean task of bringing oil production up to 6MM bpd by 2022 would take us back to per capita oil export revenues nearing $2,300. That’s close to the values observed in 2013, the year that we officially ran out of toilet paper. It’s just slightly above the 1983 figure, the year of the infamous Viernes Negro.

Sources: BP, BCV, MPPPM, WB and own calculations. Note: 2016-2022 values are projected.

Sources: BP, BCV, MPPPM, WB and own calculations. Note: 2016-2022 values are projected.

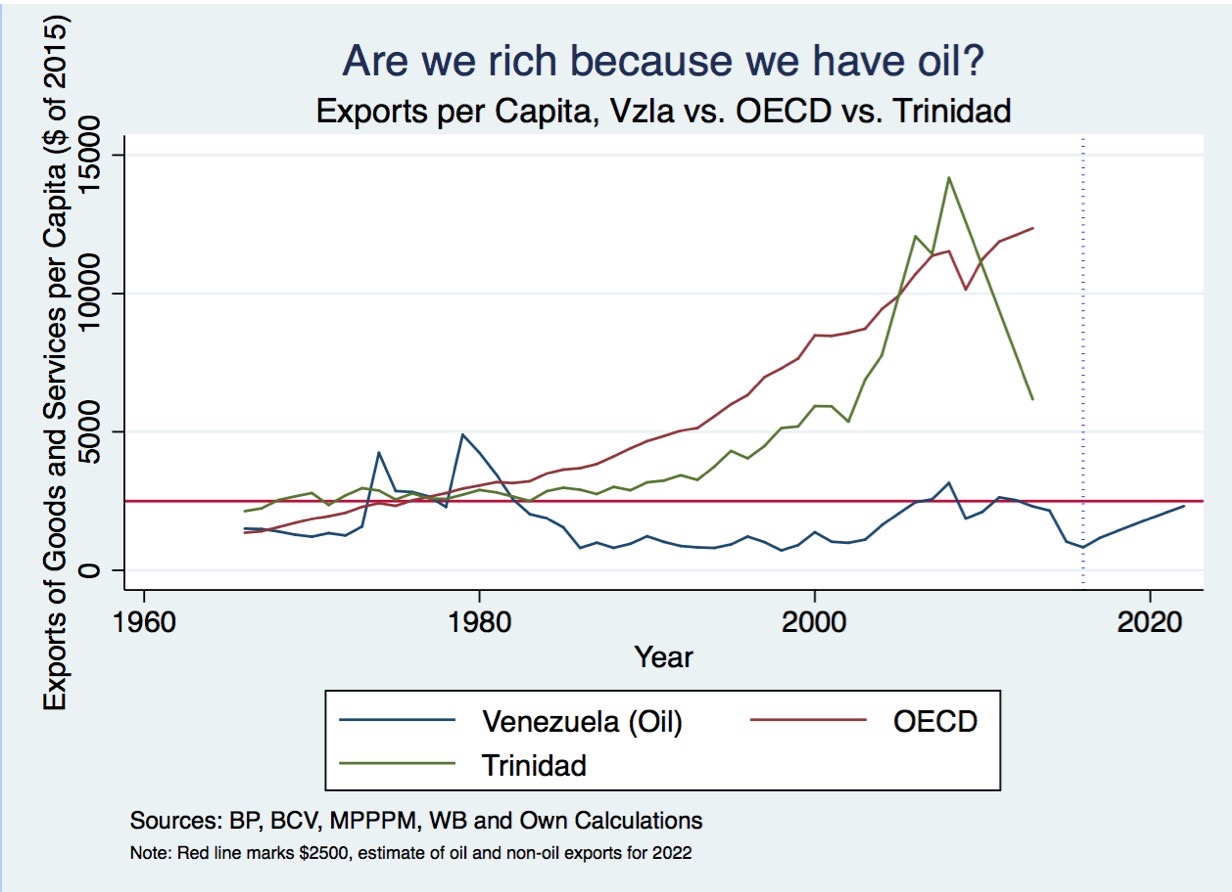

Let’s frame this differently – Meeting our most ambitious goals for the oil sector and doing nothing about non-traditional exports would take our per capita export revenues by 2022 to about:

- Half our historic maximum from almost 50 years earlier.

- Less than half of Trinidad and Tobago’s exports per capita from 10 years earlier.

- Less than a fifth of OECD’s exports per capita from 10 years earlier.

Moreover, in order to get us to about half of OECD’s 2013 exports per capita -roughly the exports per capita of Trinidad that year- the Venezuelan oil basket would need to crawl back up to $115 (WTI / Brent above $125) per barrel, or production would need to go up to 14MM barrels per day. Today, these are part of no one’s scenario.

So, are we rich because we have oil?

So, are we rich because we have oil?

No, we are not, and we wouldn’t be if we effectively went on to meet our most ambitious goals for the sector. The idea that Venezuela, a country with over 30MM people, could be as rich as the Arab oil producers -or even Trinidad- if we just managed the oil sector adequately is a myth. El petroleo le quedó chiquito al país.

This is not to say that oil is not fundamental for what’s to come, or that the discussion on how to reach our goals for the sector is unwarranted. By all means, Venezuela must meet its God-given potential in the oil sector, and all the “oil-nerdistry” we can muster is necessary in envisioning a strategy that can take us there. Achieving our goals would probably require an ambitious Apertura Petrolera: a thorough revision of the fiscal and regulatory frameworks to allow for vast private investments under a risky landscape and macro-projects that imply costly production structures for relatively less valuable output (i.e. Faja). This is a stimulating policy challenge that will require the thoughtful design and untiring implementation that only the Petroleros can bring to the table.

But from an economic development perspective, the Petrocéntrico mindset that productive diversification should not be a policy goal is both wrong and dangerous. Sadly, that is the core message I took away from Amanda’s Uslar-bashing extravaganza some weeks ago.

I don’t have much love for Uslar, as he ultimately used all his prestige and legitimacy to undermine the modernization agenda of the 90s. But for all his flaws, challenging the country to avoid comfort in easy money and inviting us to find productive uses for it was not one of them. Uslar’s vision of oil being both a temporary and uncontrollable source of revenues gets at an essential truth about oil markets even today.

While we now know that we have infinite amounts of oil for any practical purposes, oil remains a temporary source of revenues: We may not know oil’s exact technological expiration date, but are we really sure it’s far beyond 2040? Moreover, Venezuelans should be experts about the perils of “external factors and decisions” in determining oil revenues –especially today, when a drastic technological shift and the decisions of middle-eastern kings have such damaging effects on our everyday lives.

Moving beyond Uslar, I fear for the narrative behind Amanda’s piece to stick, as “Sembrar el Petróleo” stuck. She’s not shy about it: “If you’re born rich…”, “rich people problems…”, “stop daydreaming about fostering tradable-goods”, “bizarrely (the Dutch Disease) is considered a problem”. The underlying message is pretty clear: “Somos ricos porque tenemos petróleo, lo que hay que hacer es sacarlo”.

Lacking the money or prospects of the 70’s, this Venezuela Saudita illusion is sadly making a comeback in some circles: I try to teach at UCAB’s School of Economics every time I’m in Caracas. More and more, I find it a common place for the small group of policy-oriented kids to say “Hey, let’s just get the oil side straight, and just let the market take care of the rest”. This scary convergence in their thinking may be caused by misidentifying the factors behind the mismanagement of oil rents in Venezuela.

On incentives and false dichotomies

Clearly, things have not gone right for Venezuela, and clearly something has to change if we are to expect different results. But what’s the fundamental change that needs to occur if we want to enter an economic development path?

In broad strokes, the Petrocéntrico train of thought sees the major economic flaws in our democratic history as due to the excesses of different governments who, enabled for misallocation by the lingering narrative of “Sembrar el Petróleo”, always found ways to funnel funds towards erratic policy goals that ended in inefficiency, mismanagement and graft.

A different view is that incentives to use oil moneys for political purposes would have still prevailed in the absence of such a narrative. The institutional origins of oil mismanagement lay on what Luis Pedro and Pedro Luis Rodriguez have defined as discretional rentism, which I have also called oil opportunism: when the incumbent has the capacity to manage large oil rents at will, the stakes in power are so great that they break incentives for societal cooperation around shared long-term development goals. To the contrary, the discretional management of oil rents leads to voracity and political opportunism, undermining policy making and polarizing the political dialogue.

In that front, some of Amanda’s policy suggestions are on point in aiming at reducing the discretional capacity for the government to manage oil rents and other decisions. While it’s difficult to think of a government that would organically decide to tie its hands and rescind power, it is precisely in a situation of crisis with constitutional ramifications -such as today’s- that the renegotiation of the social contract in this direction becomes possible.

For instance, in a constitutional event, we could decide to follow the Rodriguez’s proposal for the “Fondo Patrimonial de los Venezolanos”. Or we could just transfer rents and then tax back for whatever policy purposes are deemed justified. Alternatively, we could earmark the policy uses of oil rents. Or we could think of something like Alaska’s Savings Fund on top of a stabilization mechanism. All of these should probably be discussed as mid-term goals in the context of the severe fiscal and external deficits that need to be addressed as a short term prerequisite.

There are many things that could be done to address oil opportunism, but… that says nothing about whether diversification should be a policy goal or not. If we don’t argue against public interventions in health and education because of past mismanagement, the same should go for productive development policies. Everything that’s blamed on “Sembrar el Petróleo” is nothing but the consequence an institutional breakdown that would have still been there had Uslar never been born.

Productive development as a policy goal for Venezuela

The development of the oil sector is a fundamental building block for a long-term economic development strategy, but it cannot become the economic development strategy. Oil can only take us so far, and it worries me that no one is discussing the need to increase productivity and diversify. Venezuelans should be thinking about smart productive development policies as intensely as they are thinking about it in Mexico, Colombia, Peru, Chile, Brazil and –even more telling for Venezuela- Saudi Arabia.

Beyond the need to export so much more than what’s feasible through oil specialization, diversification leads to a more robust and stable process of economic growth, it allows for expanded sources of domestic high-quality jobs and it leads to strong innovation spillovers. Sadly, there’s no nerdistry talking about the private sector development strategy of the next government, or discussing how a new government might institutionalize the management of oil rents to avoid them from hampering macro stability and competitiveness of other economic sectors.

I see no nerdistry on how to promote investments in pioneering sectors in Venezuela, or how to promote a venture capital, angel investment, and incubator and accelerator ecosystem in Venezuela. No one is discussing the institutional design of intelligent and modern industrial policies that overcome the failures of the old Latin American approach. There are no conversations about what the actual role of the Ministry of Higher Education, Science and Technology and the Ministry of Planning should be in tackling coordination failures that prevent innovative business initiatives and in building the groundwork for a competitive Venezuela in an increasingly knowledge-intensive world economy.

All current discussions are about stabilization macroeconomics and oil. Those are obviously urgent and fundamental tasks. But ignoring microeconomic development is to sin by omission.

We can create an Agencia Nacional de Hidrocarburos AND an Agencia Nacional de Desarrollo Productivo, both with the same degrees of institutional independence, accountability and clarity of mandates. BANDES could become something similar to BNDES in Brazil, NAFIN in Mexico, CORFO in Chile or BANCOLDEX in Colombia. Not all of the projects these institutions fund are successful, as the process of productive self-discovery is, by nature, experimental. But through a complex set of policies, they are helping push forward the process of creative destruction in non-extractive sectors of our extractive economies.

The process of productive self-discovery is not about finding “the substitute for oil”, or a “new oil sector”.

If there is one critique on Uslar’s “Sembrar el Petróleo” I share is its unwarranted physiocratic bias. Why should we prioritize topocho sowing over medicine production? No one can really say ex-ante what a society can be internationally competitive in –and although the current productive or export structure of a society can provide some hints, our focus on oil suggests limited spillover possibilities. Beyond setting all hopes in a single sector, this view suggests that broad experimentation is at the heart of local innovation, productive development and economic growth.

So let’s start a conversation about how to build an ecosystem where risk-taking and pioneering entrepreneurship is encouraged, where productivity is rewarded, where the role of the private sector as the engine of wealth creation is valued, and where its constraints on higher productivity are heard, understood and addressed.

Make no mistake – private sector development is directly undermined by the view that we are rich because we have oil. Actually, the battered stance of private enterprise and liberal values in Venezuela is a direct consequence of the Petrocéntrico narrative. If we are rich because we have oil, then why do we need a private sector? The government does not need to collect taxes, and people do not need jobs. All focus is set around the distribution of rents, not around the creation of wealth. If Rentismo was the Zika virus, the thought that oil makes us rich is the puddle where mosquitos grow.

We can’t just keep staring at our bellybuttons. We should build a system that promotes long-term cooperation around shared national goals, by eliminating opportunities for discretional use of oil rents. In that process, we need to agree on how to stabilize our macroeconomic accounts, we need to agree on how to meet the potential that we have found in the oil sector… and we need to agree on a policy and institutional framework to find out our potential in other economic activities. That’s the adaptive challenge for our generation if we want to leave our children with a country on the path to becoming rich.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate