A Tug of War with the Country in the Middle

Stop me if you’ve heard this one before: the VP for the Economy is signalling a unification in the foreign exchange regime. Maduro's far left advisors are working to block him. Who’s actually running economic policy around here, anyway?

The Maduro administration has long been a kind of ideological hostage of Alfredo Serrano, the marxist-dadaist who thinks debating Foreign Exchange (Forex) unification is like to cheating at Solitaire and was best known until recently as Luis Salas’s mentor.

But Miguel Pérez Abad, who technically runs economic policy, is getting restive. Recently, Pérez Abad went on primetime TV to unambiguously announce the government’s intention to launch the Dicom currency system, allowing it to become a true market-based rate that “accomplishes two goals: attract Forex supply, and manage currency to incentivize export substitution”.

The money quote is from Pérez Abad himself…

We’re nearing the moment of freeing up the currency, to launch the Exchange System. In particular, what’s of most interest to the domestic economy is the Complementary Exchange System… (Dicom) is an exchange rate that follows the behaviour of the market and recognizes other systems because it follows both its goals: capturing foreign exchange and administering foreign exchange for import substitution and stimulating exports.

So will Dicom really become the market-based answer to the Voldemort Rate that Sicad 1, Sicad 2 and Simadi epically failed to become? Will the system live up to the expectations Pérez Abad has been busy raising? Or will it be shot down by the Serrano doctrine of State control?

Who exactly runs economic policy around this joint, anyway?

We’re about to find out.

What are the lechugas saying about this debate?

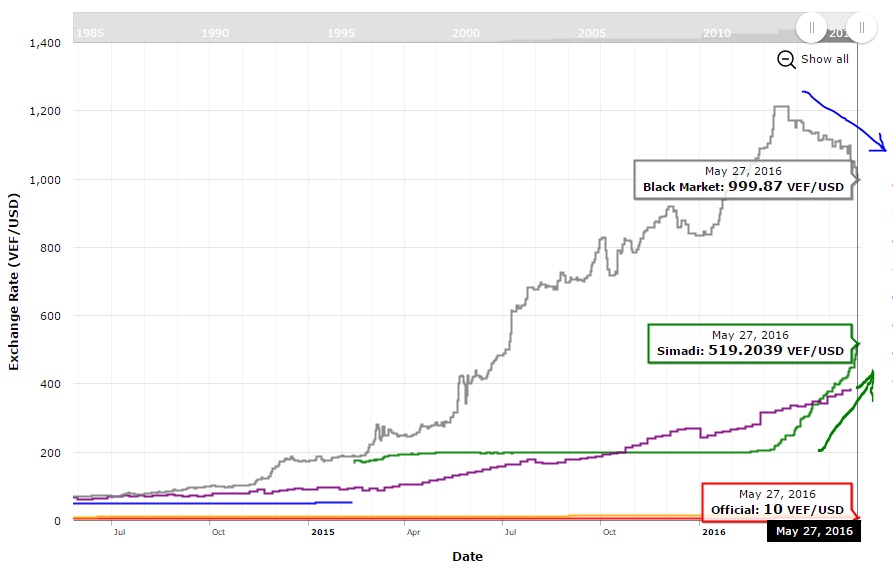

For the past two months, the black-market USD-VEF rate has been tumbling from an all-time high of 1200 bolos to the Dollar. It even dipped below the 1000 VEF/$ level last week and into Monday. The deep recession in our economy has turned almost all imports into unaffordable luxuries for most, which has led to a slump in demand for hard currency for transactional purposes.

At the same time, there has been a massive drop in speculative demand for greenbacks: traders are calling a temporary ‘top’ on the black dollar, and a market that has done nothing but climb for the past couple of years is now trading more than 20% off its record level.

According to a recent Panorama piece, the single most important development driving the “run” on the parallel lechuga is the fast rise in the Simadi – technically not yet Dicom – rate, which has been allowed to slide by the Central Bank from 200 to 520 VEF/$ in less than two months. Furthermore, local traders involved in Simadi operations have disclosed that several recent orders have been approved by the BCV – and hence traded – at prices way above the daily reported ‘midpoint’ level; sometimes already over the 600 VEF/$ mark.

I don’t think Serrano would approve of that, would he?

Volumes on the Simadi market are still minimal: a bit less than 8% of the total forex allocation and thus not a significant share of the weighted average rate, according to research from our Anabella Abadi and her folks at ODH Consultores. But the sheer scale and speed of the devaluation that has been allowed by the economic authorities, while still largely symbolic, is pushing some folks to speculate that Perez Abad might be winning the debate, and that the government is going to take down the black market, this time for real.

To the naked eye, it seems like both rates were to converge somewhere around the 800 VEF/$ mark in the space of a couple months if they keep their recent price trends (HT: Girish Gupta):

Don’t count Serranomics out just yet

Don’t count Serranomics out just yet

There’s a solid line of thought against the ’unification’ story that should dampen any excess of #TeamAbad optimism. First of all, the obvious: the country is near-bankrupt, with Central Bank reserves at 12-year lows.

“The trouble with forex unification is that there are no reserves”, as Jose Guerra puts succinctly. What would be the point on opening up a market that’s so clearly predisposed for a speculative run on the local currency? Moreover, the chavistas have always been clear about the political motivation behind its ironclad support for the forex regime. Remember Aristóbulo? That’s Alfredo Serrano logic right there, and it doesn’t bode well for any unification initiative.

Going by Serrano’s words, the very ideas of supply and demand are irreconcilable with his nutcase brand of economics. The Podemos advisor has been vocal from the get-go about his distaste for market-based foreign exchange policy, and the resonance of its “economic war” nonsense in the Maduro administration discourse is evident.

The CrónicaUno x CaracasChron exclusive interview is crammed full of these worrisome brain farts. As he’s sitting his stride in a tired old ñángara tirdade justifying state control in the economy, Serrano says “Why do you care so much about the exchange rate if there’s no access to dollars anyway?” That right there tells you all you need to know about why he shouldn’t be let anywhere near economic policy-making.

Part of me thinks even a guy like Serrano can’t really imagine he can stuff the Simadi toothpaste back into the tube, though. Prices for all sorts of goods and services, be it consumer staples, customs duties, or consular tariffs, are being adjusted by the government at or near Simadi levels. Like we said, the black market dollar has been trading heavy for a while now, with no signs of changing direction. Even in a scenario where Perez Abad loses the economic policy battle, the economy is already reflecting a convergence between the parallel and the Simadi/Dicom rates, and money talks louder than a Businessman-turned-Bureaucrat or the “Jesus Christ of economics” could ever hope to.

Who’s the Boss?

Because the Forex fight isn’t just about Forex policy – crucial though that is – this is about who actually gets to make economic policy in the first place. While we’re consumed by this tug of war between mere garden variety incompetence and the economics of the insane asylum, hyperinflation is starting to kick in.

Depending on how this fight pans out, we could be placing the economy in the hand of people able to avoid total macroeconomic disarray, or we could be handing it to people who positively relish it.

We hope that this debate gets settled very soon, and for the best, because every day of inaction further degrades Venezuelans’ already tragically collapsing living standards.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate