Chavismo's political agency problem

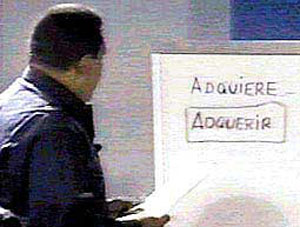

Turn on the TV, and it strikes you in the face – the stratospheric stupidity of the people in charge in Venezuela. Whether it’s Nicolás Maduro talking about how soap operas create violence, or Eudomar Tovar struggling with simple graphs, the question that begs asking is: why do we have such mediocre statesmen? How did we end up with people who so openly disdain knowledge?

Turn on the TV, and it strikes you in the face – the stratospheric stupidity of the people in charge in Venezuela. Whether it’s Nicolás Maduro talking about how soap operas create violence, or Eudomar Tovar struggling with simple graphs, the question that begs asking is: why do we have such mediocre statesmen? How did we end up with people who so openly disdain knowledge?

Turns out – there’s a scientific explanation for it!

In a provocative new paper by Brollo et al. (2013), published in the American Economic Review, the authors blame our old foe the resource curse. The authors claim that resource curses increase observed corruption and reduce the average education of candidates for political office.

In other words, resource windfalls create a “political agency” problem, whereby the pool of possible candidates for powerful positions becomes crowded with pestilent characters of unseemly reputation who somehow always end up winning.

Agency problems are common in economics and politics. The basic framework of the agency problem is as follows: in many relationships there is a principal (the main staeholder) and an agent in charge of executing the principal’s wishes). Sometimes, what the principal wants to get out of the relationship does not coincide with what the agent wants.

This is common in companies. Think of the principal as the shareholders of the company. They want to maximize the value of the company’s stock. The agent is the general manager, but he might be more interested in maximizing the company’s growth, because that way he gets his face splashed all over the papers. Since the principals don’t observe the details of all the actions taken by the agent – what economists term “asymmetric information” – the agent can get away with doing something slightly different than what the principals want. Solving the agency problem is a key challenge of all organizations.

According to Brollo et al., a resource windfall means that there are high rewards for politicians to grab their share of the pie without sacrificing basic services for people, i.e., you can get away with corruption more easily. Because corruption is more freely available, more people who are solely interested in corruption will enter the pool of possible candidates, and somehow get themselves elected.

In technical terms:

The model highlights several political effects of an increase in non-tax government revenues. First, there is an effect on moral hazard: with a larger budget size, the incumbent has more room to grab political rents without disappointing rational but imperfectly informed voters. In other words, the electoral punishment of corruption decreases with budget size, and this induces the incumbent to misbehave more frequently. Second, there is a selection effect: a larger budget induces a decline in the average ability of the pool of individuals entering politics. This is a by-product of the first result (that rents increase with budget size) and of the assumption that political rents are more valuable for political candidates of lower ability. The selection effect in turn magnifies the adverse consequences on moral hazard: an incumbent facing less able opponents can marginally grab more rents without hurting his reelection prospects. As a result, and despite the increased level of corruption, in equilibrium a windfall of government revenues also increases the reelection probability of the incumbent.

They tested this hypothesis on a set of Brazilian municipalities that received a resource windfall:

“Specifically, an (exogenous) increase in federal transfers by 10 percent raises the incidence of a broad measure of corruption by 4.7 percentage points (about 6 percent with respect to the average incidence), and the incidence of a more restrictive measure—including only severe violation episodes—by 7.3 percentage points (about 16 percent). At the same time, larger transfers by 10 percent worsen the quality of the political candidates challenging the incumbent, decreasing the fraction of opponents with at least a college degree by 2.7 percentage points (about 6 percent). As a result, an incumbent receiving larger transfers experiences a raise in his probability of reelection by 4 percentage points (about 7 percent).”

Yet one more thing we can blame oil for…

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 22 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate