Venezuela is a Ponzi scheme

Quiet … con man at work.

(Posted on Foreign Policy´s Transitions blog)

A pyramid scheme called Venezuela

By Juan Cristobal Nagel

Hugo Chávez, Venezuela’s embattled president, is living on borrowed time. The real problem for Venezuelans, though, is that their economy is also living on borrowed time, and the day of fiscal reckoning may be near. Venezuela has an enormous fiscal deficit, and it is running out of places to borrow from. Like Ponzi schemes, the Venezuelan government needs ever growing sources of funding in order to keep paying for the generous promises it has made to its people.

The Chávez administration’s record on fiscal issues is, in pure chavista fashion, deeply red. Last year, in order to secure re-election, the fiscal deficit reached 15 percent of GDP, according to The Economist. In spite of record high oil prices that saw state revenues balloon relative to historic levels, the government found that it had to spend billions of dollars it did not have to give people appliances and apartment homes.

But 2012 wasn’t a one-off affair. Even though the deficit was absurdly high, it was only fitting for an administration that has rarely balanced its numbers. In 2003, for example, the fiscal deficit was around 5 percent of GDP. Only in 2005 and 2006 did the numbers look reasonable — but population growth and increased subsidies mean those days are gone for good.

Foreign banks lend to Venezuela at very high rates, reflecting the inherent uncertainty of lending to a country where one person makes all the decisions. The extra yield from Venezuelan bonds demanded by the market in order attractive in comparison wtih U.S. Treasury bills is 722 points — more than double that of countries such as Sri Lanka or Zambia, and much higher than neighboring, slumping Brazil. In spite of this, or because of it, bankers have benefitted mightily during the Chávez years.

That is mostly due to the fact that Chávez never misses a bond payment. In a provocative article, Bloomberg’s Ye Xie and Nathan Crooks report that, over the years, Venezuelan bonds have yielded 14.7 percent annually, a very high figure even for emerging markets.

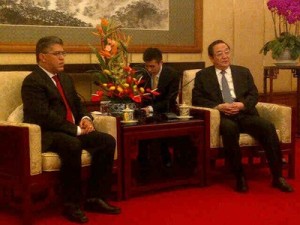

As it likely faces yet another presidential election, the government is desperate for new funding. In the last few years, it has received fresh money from China (at, presumably, better rates than the market) as part of an obscure loans-for-oil scheme, the details of which have yet to be fully revealed. But recent reports suggest the Chinese are reluctant to continue with the flow of money, citing unhappiness with the uses to which their funding is being put and the quality of the oil being provided.

This spells trouble for Venezuela. The situation — large historical returns to investors, a structural inability to balance the books, complete lack of transparency on how it gets funding and what it spends on, and an increased scrambling for ever higher sources of funding just to stay in business — has all the classic marks of a Ponzi scheme. Substitute “Bernie Madoff” for “Hugo Chávez,” and the situation in Venezuela looks remarkably similar to the famous pyramid built by the notorious American fraudster (except, perhaps, for the fact that Chávez will never go to prison).

After 14 years in which he has expropriated everything from oil companies to jewelry stores, one thing is clear about Hugo Chávez: He loves other people’s money. But as with all Ponzi scams before him, there will come a point when El Comandante will run out of cash. Only high oil prices are preventing this house of cards from collapsing.

Someday, the music will stop, and Venezuelans — and their bondholders — will be left with the bill.

Caracas Chronicles is 100% reader-supported.

We’ve been able to hang on for 21 years in one of the craziest media landscapes in the world. We’ve seen different media outlets in Venezuela (and abroad) closing shop, something we’re looking to avoid at all costs. Your collaboration goes a long way in helping us weather the storm.

Donate